maryland tax lien payment plan

Taxpayers who owe past-due state taxes may be able to qualify for a. Durations of 36 to 60 months are possible.

Tax Liens Background Checks Goodhire

The case began with a Montgomery County man Kenneth R.

. You can pay your Individual Maryland taxes with a personal check or money order if you prefer not to pay electronically or with a credit card. Optima Tax Relief is BBB Accredited with an A Rating - Free Consultation. Make a credit card payment.

The State Tax Sale Ombudsmans Office can refer homeowners to legal resources that may be able to help. Free Consult Quote. A Maryland tax payment plan may be available if you have a state tax liability that is beyond your means.

Maryland utilizes a tax lien certificate system to collect delinquent property taxes. Should the taxpayer timely make all payments under the OIC the Comptroller will release all tax liens. Hello I had a Maryland Tax Lien showing on my CR since September 2011 for unpaid for 2005.

A tax lien may damage your credit score and can only be released when the back tax is paid in full. Sales are published in the local newspaper and. Alternative electronic check payment options are available through the office of the Comptroller of Maryland.

This is an ongoing. If you file electronically and pay by check or. There is a 249 service charge because this is processed via.

Welcome to the Comptroller of Marylands Online Payment Agreement Request Service. Ad IRS Interest Rates Have Increased. Ad Real Estate Landlord Tenant Estate Planning Power of Attorney Affidavits and More.

It ranges from 3-15 years depending on the state and resets each time you make a payment. A Maryland tax payment plan may be available if you have a state tax liability that is beyond your means. For business tax liabilities call 410-767-1601.

You can apply for a Maryland state tax payment plan by indicating that. Select Popular Legal Forms Packages of Any Category. Help With a Maryland Offer in Compromise and TaxCure If the taxpayers OIC gets.

However if you cant pay your taxes you may be able to negotiate to get your lien. There are a few ways you can pay a Maryland tax debt. So I never received.

Check your Maryland tax liens. All Major Categories Covered. Act Quickly to Resolve Your Tax Problems.

100s of Top Rated Local Professionals Waiting to Help You Today. Maryland tax lien payment plan Friday February 25 2022 Edit. Maryland tax lien payment plan.

Or you can send. Tax sale dates are determined and vary by individual counties. If you have additional questions please dont hesitate to contact the State Tax.

I lived there for about two years and then left since 2005. Ad IRS Interest Rates Have Increased. The only surefire way to get rid of your Maryland tax lien is to pay your tax debt in full.

You may use this service to set up an online payment agreement for your Maryland personal income tax. Optima Tax Relief is BBB Accredited with an A Rating - Free Consultation. You can wait for a notice and pay with that voucher.

Make a personal estimated payment - Form PV. Act Quickly to Resolve Your Tax Problems. You can send money in with your tax return.

Contact 1-800-MD TAXES 1-800-638-2937 or taxhelpmarylandtaxesgov. For individual tax liabilities call 410-260-7482 260-7623 or 1-800-MD-TAXES or e-mail sutmarylandtaxesgov for either tax. Our Trained Tax Pros Will Fight in Your Corner.

This electronic government service includes a serviceconvenience. Ad Find Best Solution to Your Unpaid Taxes. Make a personal extension payment - Form PV.

Taxpayers can apply for this program online or when responding to.

Owe The Irs Your Home Equity Could Help With Your 2021 Taxes

Maryland Tax Relief Information Larson Tax Relief

Common Irs Audit Triggers Bloomberg Tax

We Solve Tax Problems Debt Relief Programs Irs Taxes Tax Debt

Irs Notice Cp42 Form 1040 Overpayment H R Block

5 17 2 Federal Tax Liens Internal Revenue Service

Evaluate Market Conditions To Determine The Right Price To Sell Your Home There Are Many Factors To Consid Sell Your House Fast Sale House Sell My House Fast

How To Avoid A Maryland State Tax Lien

When Does An Irs Tax Lien Expire Rjs Law Tax And Estate Planning

Experts Believe China Is Far From Uninterested In Cryptocurrency Despite Its Overt Efforts At Bans Of One Kind Or Anoth Cryptocurrency Bitcoin Bitcoin Currency

Payment Plan Template Free Fresh Payment Plan Templates 10 Download Free Documents In Pdf How To Plan Marketing Plan Template Contract Template

Thoughtful Planning And Impeccable Execution Have Always Been Our Hallmark House Cost The Fox And The Hound Holiday Decor

Can I Start A Business If I Owe Taxes A Guide

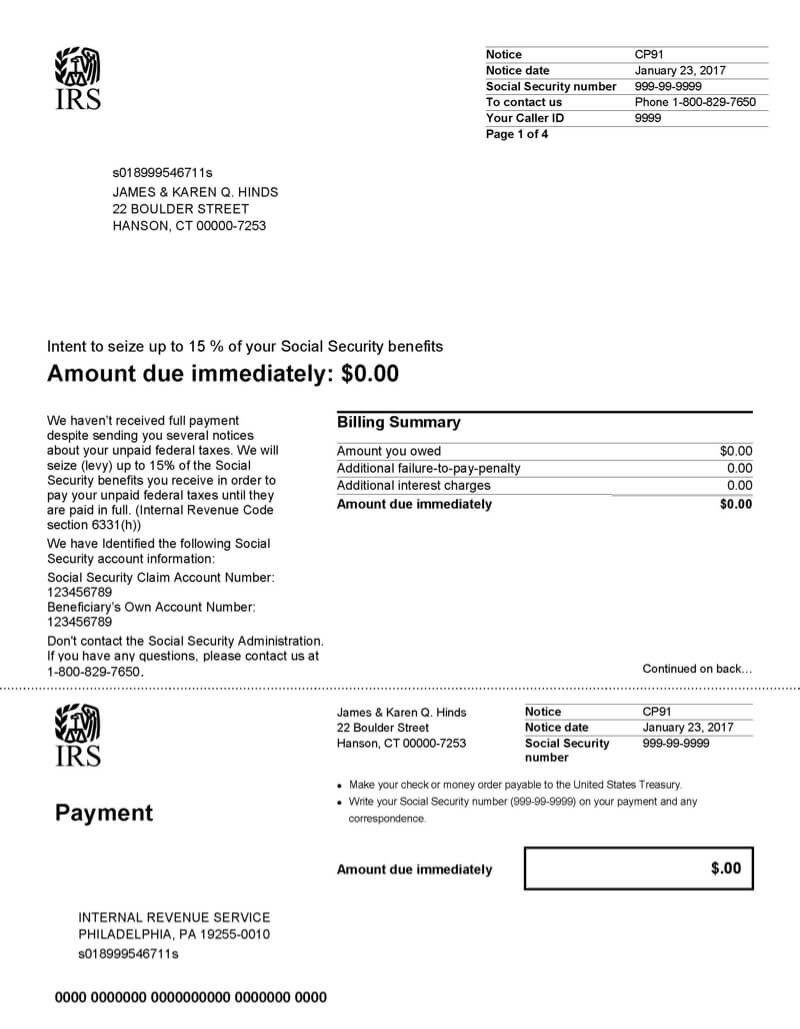

What Is A Cp91 Irs Notice Jackson Hewitt

Where S My State Refund Track Your Refund In Every State

Real Estate Property Tax Jackson County Mo